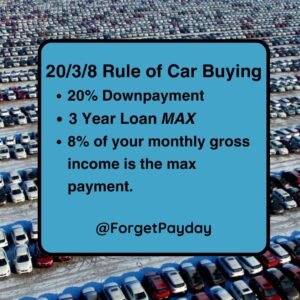

“The 20/3/8 Rule will keep you from buying more car than your life can afford.”

Confession. I’m a car guy. I love cars, I love writing about cars, and I genuinely love driving. I have a particular affinity for eccentric roadsters, manual transmissions, and high performance off roaders. I even love maintaining my own vehicles and take great satisfaction in DIY oil changes and tire rotations. In the past, I have also committed every known financial sin when it comes to buying a car. Frequently traded, went upside down, bought stupid cars at cross purposes with my life. I’ve bought extended warranties, undercoating, and got led like a sheep to the slaughterhouse. I haven’t leased one, but that’s about it.

As much as I love cars, they are pure mayhem on your financial life. Cars are typically the most expensive depreciating asset a person will ever buy. With respect to the unpredictable collector market and the overall market over the last couple of years, cars cost a ton of money and depreciate rapidly. Typically, a car will lose 20% of its value the first year and 15% of the remaining value every year thereafter. Not only will the depreciation crush your budget; you must fuel, insure, license, and maintain your vehicle into perpetuity as well.

As an ongoing drain on your cash, a car knows few peers.

In most of the United States a car is a necessary component of everyday life. We grew up as a nation in love with the automobile and our cities and towns have grown up auto centric. For that matter, many U.S. cities aren’t particularly walkable, have mediocre public transit options (if any at all), and bicycles are recreation instead of transportation. If you live in a rural area, a car just isn’t an optional purchase.

So then, how do you deal with purchasing something so anathema to your wealth building? As much as I love the automobile, it is the equivalent of playing with a live financial hand grenade. Many pundits offer that the only sensible solution is to buy the cheapest used car in cash you can manage and replace it when necessary and upgrade it when you can. I’ve done that and I will admit the plan leaves a lot to be desired.

Life sucks when you’re on a never-ending quest for better transportation and playing Russian roulette every morning when you turn the key to go to work in your $1000 “hoopty”.

We can do better than that without falling prey to the current 2023 $48,000 median priced car financed for a median 76 months. In the modern market, the average loan term is 76 months with 60 months being considered “short” and “long options” of 84 and 96 months available. Let’s be real here, most people in America can’t commit to a spouse for 84 months, much less a car.

I get it. Cars are expensive and you need one that works without eating you alive in the process. Here’s the guideline.

20% of the car’s purchase price in a down payment. More is better if you’ve got it. Heck, if you can swing 100% down, that’s optimal but that certainly isn’t everyone. If you haven’t got 20% down, you’re in poor position to buy that car to start with and need to save more or shop for a less expensive ride.

3 years is the maximum loan length. I know you can borrow for a lot longer term but hear me out here.

YOU DO NOT WANT TO FINANCE CARS FOR MORE THAN 3 YEARS.

Depreciation will eat half of the car’s value in the first three years. If you finance one for 72 months, it isn’t even halfway paid off. If you pick a crappy car or pile on miles and damage…it will be worth even less. Either way, you will have a “gap” between what the car is worth and what you owe. You can buy “GAP insurance” to cover your lender should you total it while you are upside down in value, yet another cost to owning a car you can’t afford. I’ve yet to see anyone who put 20% down on a 3-year note get upside down. You’re paying it off much faster than the depreciation curve. You get a better rate on 3-year notes as well, since the bank is taking on less risk.

8% of your monthly gross income is the maximum car payment. I fully realize that banks and lenders will gladly let you take on more car (and will equally let you pay for it for two Presidential terms) but the idea here is to keep your car at the appropriate size for your budget. Sinking a lot of cash into a depreciating asset is the opposite of building wealth, it’s destroying it.

Taken together, the 20/3/8 Rule will keep you from buying more car than your life can afford.

Some other thoughts to consider here.

- Cars last a lot longer than they used to. Long gone are the days when 100,000 miles on the odometer meant a worn-out car. Many cars today will go 100k on the factory set of spark plugs. Many brands will top 200,000 easily with preventive maintenance and mechanical sympathy and 300,000 happens regularly among the best brands. I would have never considered a used car with 80,000 or more miles on it in years past, now that’s well within reasonable.

- Condition matters more than mileage. Just because well cared for cars will go to the moon and back doesn’t mean they all will. If you’re buying used, look for maintenance records and overall condition. An abused or poorly maintained car will be unlikely to last as long as a well maintained one. Pass on cars that have been visibly rode hard and put up wet.

- Buying a lower trim car that’s new will likely be a better deal than buying a loaded model used. I’m not talking the economy boxes here. I’m talking the fleet specification trims that aren’t feature laden. For example, you can load up a Toyota Camry XLE or Limited to top $40k easily but the SE trim can be had for $27,000. Same engine, same drivetrain, same reliability…different seats and infotainment. The bells and whistles are nice if you can swing them, but you won’t miss them if you can’t.

- Don’t buy more car than you need. In a similar vein to #3, buying a full size SUV doesn’t make any sense if you’re a solo urban commuter. Be realistic about how your life fits your car. The parking lot at my work is chocked with full size diesel 4x4s…90% of which will never pull a trailer or leave the pavement. Most three row SUVs never carry anyone in the third row and the most powerful sports cars must obey the same speed limit as everyone else.

- Cars are a long-term play now. With better reliability and longevity, there’s no reason to trade every 3-4 years like folks used to do. The longer you can keep your car after it’s paid for, the better off you’ll be financially. “Fully Depreciated, Still In Use” are words to live by.

- Don’t sacrifice safety. Driving is dangerous, too dangerous to do in a worn-out jalopy. Car crashes are frequent so stack the deck in your favor by buying safety to start with and maintaining it well.

- Some cars just suck. Do your research and look at the track records for reliability and longevity. Avoid brands and models that need frequent expensive maintenance or have a high failure rate.

With some careful self-reflection and judicious shopping, you should be able to find a set of wheels that fits your life, your taste, and your budget.